These are accounts that embrace all of the bills incurred by your business. These embody both operating and non-operating bills. An working expense is any price associated to major enterprise operations just like the sale of goods and companies.

Let’s say your mom invests $1,000 of her own money into your company. Utilizing our bucket system, your transaction would seem like the next. An accountant would say you might be “crediting” the money bucket by $600. When your business does anything—buy furniture, take out a loan, spend cash on research and development—the amount of money within the buckets modifications. Our intuitive software program automates the busywork with highly effective instruments and options designed that will help you simplify your financial administration and make informed enterprise decisions.

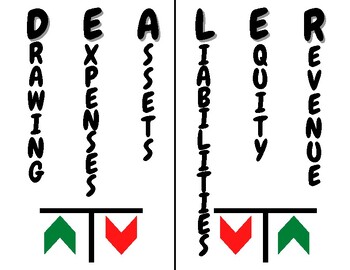

Debits And Credit Cheat Sheet: Understand Accounting Essential Ideas In A Couple Of Minutes

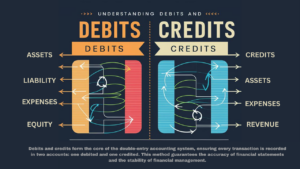

The double-entry system offers a extra comprehensive understanding of your small business transactions. Let’s go into extra element about how debits and credit work. For instance, let’s say you should purchase a brand new projector on your convention room. Since money is leaving your small business, you’d enter a credit into your money account.

Kinds Of Accounts In The Basic Ledger

- Conversely, when a credit is added to an account that normally has a credit steadiness, it will improve the amount, and a debit will lower the quantity within the account.

- You must also remember that they need to stability, which means that if a debit is added to an account, then a credit score is added to a different account.

- Correct stock data assist avoid overbuying or operating out of stock.

- Regularly checking your accounts might help you understand the financial statements and create an accurate enterprise budget.

You can set up a solver model in Excel to reconcile debits and credit. List your credit in a single row, with each debit getting its personal column. This ought to offer you a grid with credits on the left facet and debits at the top. Debits and credit tend to come back up during the closing durations of an actual estate transaction.

For Expense Accounts

A debit will increase an asset or expense account and decreases a liability or equity account. In The Meantime, a credit score decreases an asset or expense account and increases a legal responsibility or fairness. In accounting, debits and credits are methods of recording monetary transactions. Transactions are recorded as either a debit or a credit, relying on what is happening within the transaction.

Assets, liabilities, and fairness are Balance Sheet gadgets and elements of the essential accounting equation. Subsequent, when a debit is added to an account that normally has a debit steadiness, this will increase the quantity in the account. On the other hand, a credit will decrease the quantity within the account. Conversely, when a credit score is added to an account that normally has a credit score stability, this will enhance the quantity, and a debit will decrease the quantity within the account. If you’re running a enterprise utilizing accounting software program, preserving track of your finances is essential. Keep In Mind that accounting is essentially about storytelling by way of numbers.

These are the contributions invested by owners and shareholders right into a enterprise. It is what you’re left with over if you subtract liabilities from assets. The remaining quantity is called the guide value of an organization. Fairness accounts, then, symbolize what is owed to investors if the company were to liquidate its belongings.

Asset accounts observe priceless sources your company owns, similar to cash, accounts receivable, inventory https://www.simple-accounting.org/, and property. For example, when paying hire for your firm’s office each month, you’d enter a credit score in your liability account. The credit score entry sometimes goes on the best aspect of a journal. For example, if a enterprise takes out a mortgage to buy new tools, the firm would enter a debit in its equipment account as a result of it now owns a new asset. The debit entry usually goes on the left aspect of a journal. For that purpose, we’re going to simplify issues by digging into what debits and credits are in accounting terms.

The vendor refers back to the bill as a sales bill and the customer refers to the similar bill as a vendor bill. If the net realizable value of the stock is lower than the actual cost of the stock, it’s usually necessary to scale back the stock amount. To study more about the role of bookkeepers and accountants, go to our Accounting Careers web page. For the past fifty two years, Harold Averkamp (CPA, MBA) has labored as an accounting supervisor, manager, consultant, college teacher, and innovator in instructing accounting online.

These are sometimes classified; for instance, current assets are objects a company expects to transform to money within one 12 months. Five main account sorts manage all your corporation transactions within the basic ledger. Every account tracks totally different aspects of your funds and might embrace sub-accounts for more detailed monitoring. Assets on the left facet of the equation (debits) must keep in steadiness with liabilities and equity on the best side of the equation (credits). The primary difference between credit vs. debit accounting is their operate.